Navigating Market Highs and Lows

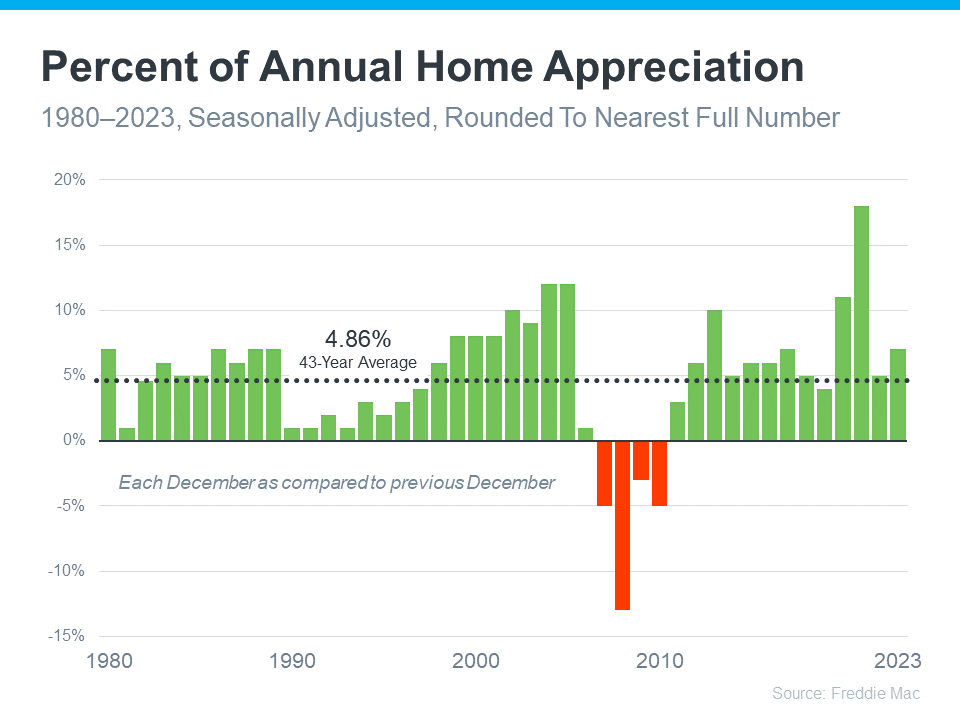

Amidst the stormy seas of economic uncertainty, there’s a steadfast beacon: the enduring value of homeownership. Despite whispers of a looming recession, 2023 proved to be a surprising success story, with home prices defying expectations and soaring to new heights.

Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, summed up this trend succinctly, highlighting 2023’s remarkable performance against decades of market data.

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

Through the peaks and valleys of market trends, one thing remains constant: the upward trajectory of home values. As noted by Forbes, the U.S. real estate market boasts a rich history of appreciation.

Looking back to 1980, a clear pattern emerges: apart from the housing market crash, home prices have consistently risen. Unlike the crisis of 2008, today’s market landscape presents a different picture. With limited available homes and homeowners enjoying substantial equity, fears of a foreclosure crisis are unwarranted.

Owning a home goes beyond mere shelter—it’s a savvy investment in your financial future. With each passing year, your property gains value, boosting your net worth.

So, if you find yourself on solid financial footing and ready to embrace the responsibilities of homeownership, now is the time to act.

Bottom Line: Home prices continue to rise, making homeownership a wise financial decision for those prepared to take the plunge. Let’s connect to explore the abundance of real estate opportunities available.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Maximizing Your Home’s Appeal and Value in the Spring Market

Maximizing Your Home’s Appeal and Value in the Spring Market