The Power of Property Ownership

Are you contemplating the leap into homeownership? Despite the seemingly daunting mortgage rates of today, here’s why taking the plunge into owning your own space could be a savvy move, if you’re in the position to do so.

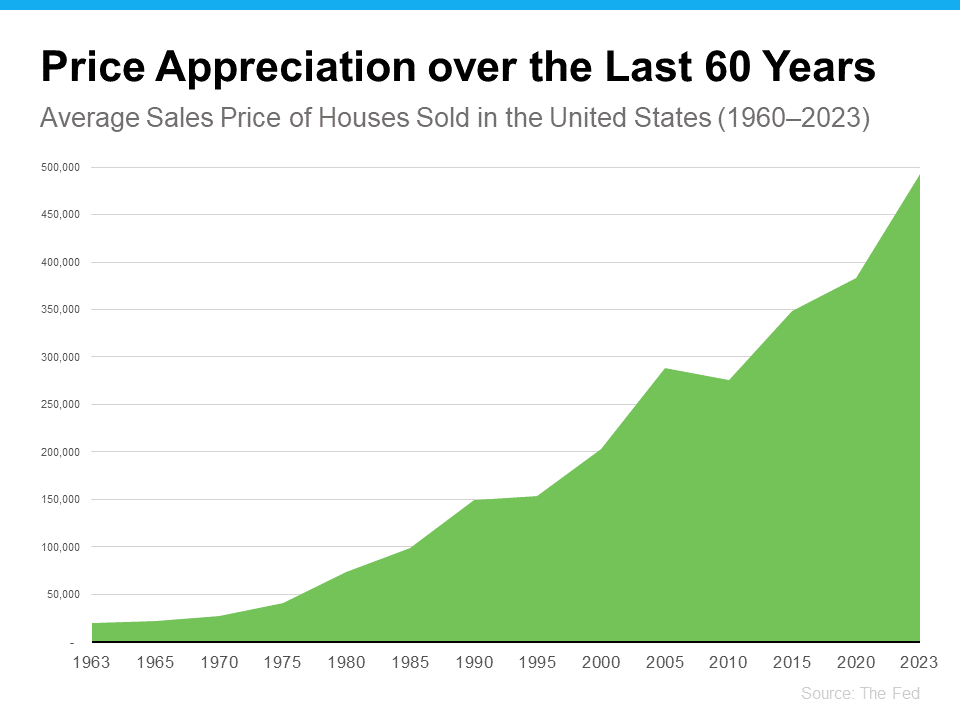

1. Home Values.

Confused about the market fluctuations? Don’t be. Nationally, home prices continue their upward trajectory. With data from the Federal Reserve backing this trend over the past six decades, it’s evident that owning a home isn’t just a shelter—it’s a pathway to building equity and securing your financial future. As the Urban Institute rightly puts it, “Homeownership is critical for wealth building and financial stability.”

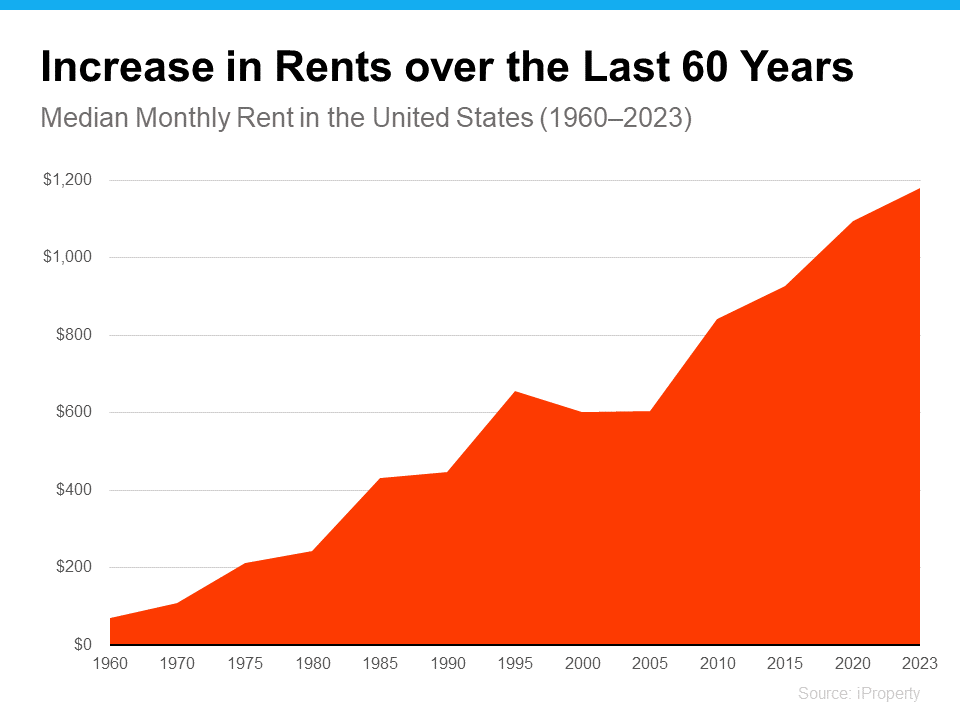

2. Rent

Sure, renting might seem cheaper in the short term, but don’t be fooled by the allure of immediate savings. Over time, rent consistently climbs upward, tightening its grip on your finances with each lease renewal. Breaking free from this cycle is crucial, and that’s where homeownership with a fixed-rate mortgage comes in as your knight in shining armor. By stabilizing your housing costs, you bid farewell to the dreaded rent hikes, paving the way for financial security and peace of mind.

In the realm of investment, your housing payments are more than just expenses—they’re contributions to your future. Dr. Jessica Lautz of the National Association of Realtors rightly points out, “If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

So, what’s the bottom line? If you’re tired of watching your rent spiral out of control and yearn for the numerous perks of homeownership, it’s time we had a conversation. Let’s explore your options and set you on the path to securing your future.

#HomeownershipBenefits, #RentVsBuy, #FinancialStability, #RealEstateInvestment

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link